Exactly How a Debt Loan Consolidation Funding Functions: Trick Insights Into Handling Financial Debt Properly and Improving Credit Report

Comprehending exactly how a debt combination car loan features is vital for individuals seeking to handle their monetary responsibilities a lot more successfully. As we explore the details of financial obligation consolidation, it comes to be apparent that the trip involves even more than just a funding; it requires a thorough understanding of personal money administration.

Recognizing Financial Debt Loan Consolidation Loans

Debt consolidation car loans act as a financial approach developed to streamline multiple financial obligations right into a solitary, manageable payment. This technique entails getting a brand-new loan to repay existing financial obligations, which might consist of bank card equilibriums, individual car loans, or various other kinds of loaning. By combining these financial debts, people can frequently profit from reduced rates of interest, lowered month-to-month repayments, or expanded repayment terms, thus alleviating the economic worry.

Usually, financial debt consolidation lendings can be found in two primary kinds: secured and unprotected. Secured finances are backed by collateral, such as a home or vehicle, which might permit lower interest rates but also positions a danger of losing the possession if settlements are not maintained. Unsecured fundings, on the other hand, do not need security yet may lug higher interest rates as a result of the raised threat for lending institutions.

Eligibility for debt consolidation finances is contingent upon different aspects, consisting of credit history debt-to-income, income, and rating proportion. It is important for consumers to carefully evaluate their monetary circumstance and think about the complete cost of the financing, consisting of fees and passion, before waging debt combination. Comprehending these elements is essential for making informed monetary choices.

Benefits of Debt Consolidation

Numerous individuals locate that settling their financial debts provides substantial advantages, eventually resulting in improved financial security. Among the main benefits is the simplification of month-to-month payments. contact us today. Rather than taking care of multiple settlements with differing due days and rate of interest, financial obligation consolidation allows debtors to focus on a single payment, which can minimize stress and anxiety and enhance financial company

In addition, debt loan consolidation can usually result in lower rate of interest. By safeguarding a lending with a reduced price than existing debts, people may save money gradually, boosting their ability to pay off the principal balance a lot more promptly. This shift can contribute to a reduction in the complete cost of borrowing.

Additionally, combining financial obligations can favorably impact credit rating. As people pay for their debts much more efficiently, their credit rating application ratio enhances, which is a key factor in credit score scoring versions. This can open doors to far better monetary chances, such as getting approved for finances or credit score cards with more desirable terms.

Lastly, financial obligation consolidation can supply an organized settlement plan, enabling individuals to establish clear economic objectives and job in the direction of becoming debt-free, fostering a feeling of empowerment and control over their economic futures.

Sorts Of Debt Combination Lendings

Combination car loans been available in numerous types, each tailored to satisfy various economic requirements and situations. One usual kind is a personal car loan, which allows debtors to integrate numerous financial debts into a solitary financing with a fixed rates of interest. This alternative is typically unprotected, meaning no collateral is called for, making it obtainable for numerous consumers.

One more popular option is a home equity finance or home equity credit line (HELOC), which leverages the customer's home as collateral. These alternatives usually include lower rate of interest because of lowered danger for lending institutions, however they need enough equity in the home and bring the risk of foreclosure if payments are not maintained.

Bank card equilibrium transfers are likewise a viable kind of financial debt consolidation, allowing people to transfer existing charge card balances to a brand-new card with a lower rates of interest, typically with an introductory 0% APR. While useful, this approach requires careful management to avoid incurring even more financial obligation.

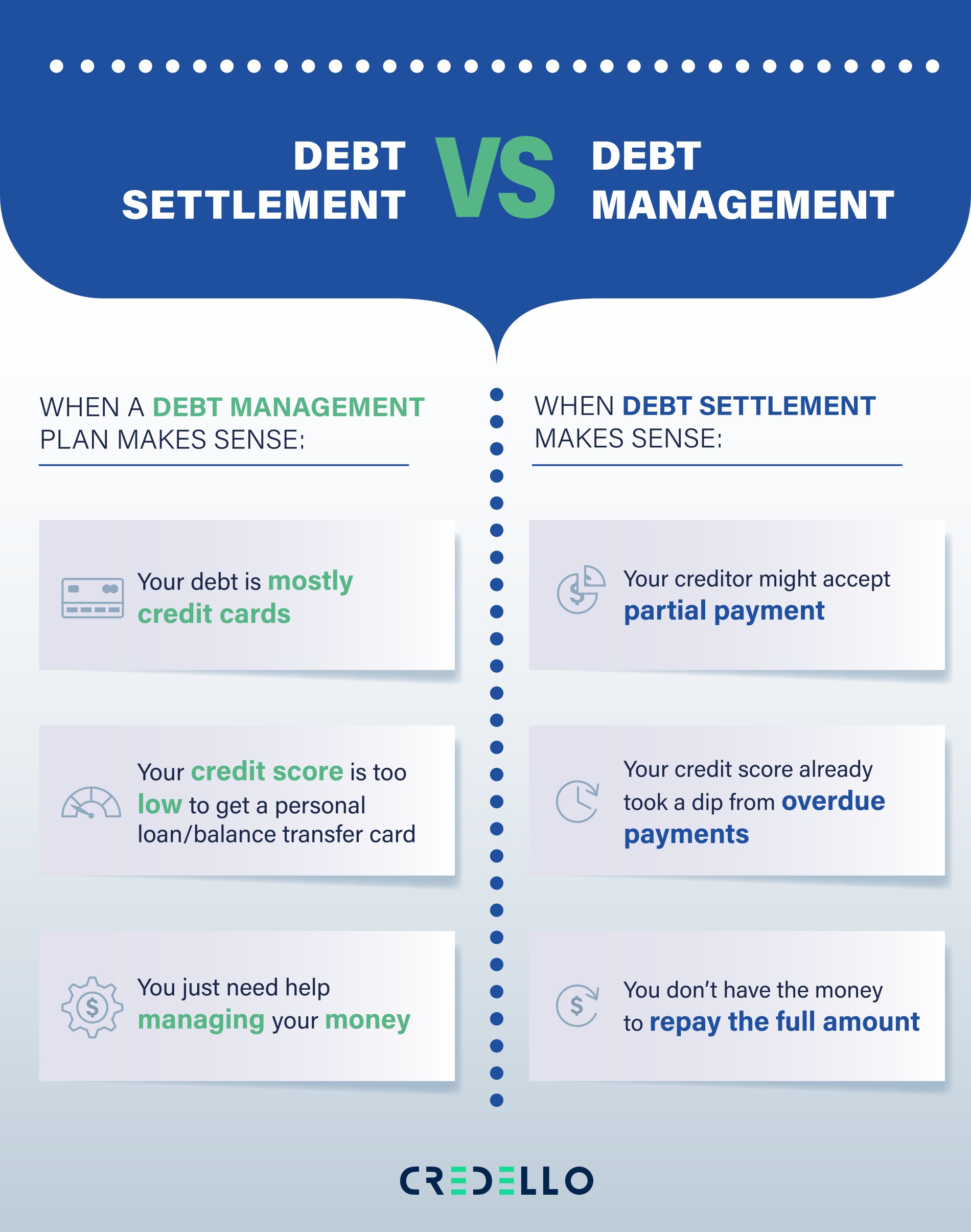

Finally, a debt management strategy (DMP) arranged by a credit score counseling firm can also consolidate financial debts, working out lower rates of interest and monthly payments with financial institutions. Each of these options presents one-of-a-kind benefits and considerations, making it vital for customers to examine their financial circumstance thoroughly.

Actions to Acquire a Debt Consolidation Car Loan

Next, examine your credit history score, as it plays a crucial role in lending approval and terms. If your rating is reduced, take into consideration taking steps to improve it before using, such as paying for existing debts or remedying any mistakes on your debt record.

Afterward, research different loan providers and lending choices - contact find more us today. Contrast passion rates, terms, costs, and qualification needs to recognize the most effective suitable for your demands. It's likewise suggested to gather required documents, such as evidence of revenue, income tax return, and recognition, to quicken the application process

When you have actually selected a lender, submit your application, making certain that all information is complete and accurate. Finally, evaluate the financing terms carefully before finalizing, guaranteeing you recognize all commitments. Adhering to these actions will certainly aid you secure a financial obligation loan consolidation car loan properly.

Impact on Credit History

While getting a financial debt loan consolidation loan can provide prompt relief from high-interest financial debts, it is important to understand its possible effect on your credit report. Initially, obtaining a consolidation lending may cause a tough inquiry on your credit score report, which commonly causes a minor dip in your rating. Nevertheless, this impact is often temporary.

As soon as the finance is safeguarded and existing financial debts are repaid, your credit scores utilization ratio is most likely to enhance. Since credit rating utilization make up around 30% of your credit report, decreasing the percentage of debt about offered credit can cause a positive adjustment in your score gradually. Furthermore, combining numerous financial debts into a single loan simplifies payment, possibly reducing the danger of late repayments, which can better enhance your credit scores account.

Verdict

In verdict, financial obligation consolidation loans offer as a strategic tool for managing numerous debts by integrating them into a solitary, potentially lower-interest loan. It is crucial to maintain regimented financial routines following debt consolidation to avoid the risks of brand-new financial obligation build-up, which can weaken the advantages accomplished via this financial method.

Debt debt consolidation fundings offer as a financial method designed to enhance multiple financial debts into a solitary, manageable payment.Eligibility for financial obligation consolidation fundings is contingent upon numerous factors, including credit rating debt-to-income, rating, and revenue proportion. One typical kind look at these guys is an individual lending, which allows debtors to integrate several financial debts right into a solitary loan with a fixed interest rate.While acquiring a financial obligation loan consolidation loan can offer immediate relief from high-interest debts, it is necessary to recognize its possible influence on your credit report score.In final thought, financial obligation combination finances offer as a calculated tool for managing numerous financial debts by integrating them into a single, potentially lower-interest lending.